Financial Freedom for Business Owners in 2026: From Survival to Strategic Autonomy

Financial freedom for business owners in 2026 is no longer defined by a single net worth target or the vague promise of "passive income"; instead, it is increasingly understood as a dynamic state of resilience, liquidity, and strategic autonomy within a global economy that is being reshaped by artificial intelligence, digital finance, geopolitical realignments, and accelerating regulatory change. For the audience of TradeProfession.com, which spans founders, executives, investors, and professionals across sectors such as artificial intelligence, banking, crypto, education, employment, and sustainable business, financial freedom now means having the structural strength and strategic optionality to make long-term decisions without being constrained by short-term cash flow pressure, overreliance on a narrow client base, or exposure to a single market or region.

In this environment, wealth is increasingly measured not only in financial capital but also in time, flexibility, and the ability to allocate attention toward innovation, strategic partnerships, and legacy-building rather than constant operational firefighting. For business leaders in the United States, United Kingdom, Germany, Canada, Australia, Singapore, and beyond, this shift demands a more sophisticated approach to capital allocation, technology adoption, and risk management. By leveraging the insights and frameworks regularly explored on TradeProfession.com, entrepreneurs can build enterprises that generate durable cash flows while preserving the freedom to adapt, innovate, and expand globally.

Reframing Financial Freedom in a Digitally Intelligent Economy

The past few years have seen a profound redefinition of what it means for a business owner to be financially free. The rise of generative AI, embedded finance, and digital-first customer behavior has pushed leaders to think beyond simple profitability toward resilient, system-based business models. On TradeProfession.com, the recurring theme is that financial freedom in 2026 is inseparable from strategic intelligence: founders and executives who understand how to harness data, automate complex workflows, and diversify both revenue and risk are better positioned to withstand shocks such as inflation spikes, supply chain disruptions, or abrupt regulatory changes in markets like the European Union or Asia-Pacific.

Artificial intelligence has become central to this evolution. Tools based on large language models and predictive analytics allow business owners to forecast demand, optimize pricing, and model multiple financial scenarios with a level of granularity that was previously accessible only to large institutions. Readers can learn more about the role of AI in strategic decision-making through resources such as TradeProfession's AI insights and external platforms like MIT Sloan Management Review, which examine how intelligent systems are changing management practices worldwide.

In parallel, the expansion of digital banking and fintech infrastructure has democratized access to sophisticated financial tools across regions from North America and Europe to Southeast Asia and Africa. Entrepreneurs can now open multi-currency accounts, access cross-border credit, and integrate real-time treasury management into their operations, significantly lowering the friction of global expansion. To better understand these shifts, business owners often refer to resources like The World Bank's finance and development reports and the banking perspectives explored on TradeProfession's banking section, which together highlight the interplay between macroeconomic trends and firm-level financial strategy.

Building a Deep Financial Foundation: Beyond Basic Literacy

While the language of "financial literacy" is common, business owners in 2026 increasingly recognize that surface-level understanding is not enough; true financial freedom rests on a deep, data-informed grasp of their company's balance sheet, cash flow dynamics, and risk profile. This begins with disciplined financial infrastructure: accurate, real-time accounting, rolling cash flow forecasts, and scenario-based budgets that can be adjusted rapidly as conditions change in markets from the United States to South Korea or Brazil.

Modern cloud accounting platforms and AI-enhanced bookkeeping systems now make it possible for even small and mid-sized enterprises to operate with institutional-grade financial visibility, yet the tools alone are not sufficient. Owners must establish governance practices around monthly financial reviews, key performance indicators, and board-level oversight to ensure that decisions are anchored in evidence rather than emotion. The principles of robust financial management are regularly discussed on TradeProfession's business hub, while external institutions such as CFA Institute and Investopedia provide structured frameworks for understanding valuation, capital structure, and risk-adjusted returns that are applicable across industries and regions.

A solid foundation also requires a disciplined approach to liquidity. Maintaining adequate cash reserves, access to revolving credit, and diversified banking relationships across stable jurisdictions such as Switzerland, Singapore, or the Netherlands can mean the difference between seizing an opportunity and being forced into defensive retrenchment. In an era where banking systems themselves are evolving through open banking and digital currencies, resources like Bank for International Settlements offer valuable insight into systemic trends that can influence how entrepreneurs position their capital.

Strategic Cash Flow Management in a Volatile World

Cash flow remains the central lifeline of any enterprise, regardless of industry or geography. In 2026, however, managing cash flow is no longer limited to tightening receivables and delaying payables; it has become an exercise in designing revenue architectures that are inherently more predictable and diversified. Subscription-based models, long-term service contracts, and usage-based pricing are increasingly being adopted by companies in sectors ranging from SaaS and professional services to manufacturing and logistics, as they provide more stable and forecastable inflows even when demand in individual markets fluctuates.

For internationally active firms in regions such as Europe, North America, and Asia, cash flow management also involves navigating foreign exchange risk and differing payment behaviors. The use of multi-currency accounts, hedging strategies, and digital payment rails helps smooth volatility and reduce friction in cross-border trade. Organizations like OECD and International Monetary Fund regularly publish analyses on global financial conditions, which informed business owners can integrate into their treasury strategies. For readers of TradeProfession.com, aligning cash flow policies with global expansion plans is a recurring theme, particularly in sections focusing on global markets and the wider economy.

Moreover, technology-driven invoicing, automated collections, and embedded financing options are becoming standard practice. By integrating AI-powered credit assessment and dynamic payment terms, companies can optimize working capital while maintaining strong client relationships. This convergence of financial operations and technology is part of the broader digital transformation journey explored in depth on TradeProfession's technology section, as well as on external platforms such as McKinsey & Company's digital finance insights.

Diversification of Revenue and Capital: Guarding Against Concentration Risk

Overreliance on a single product, client, or geography remains one of the most significant threats to entrepreneurial financial freedom. The events of the early 2020s-from supply chain disruptions in Asia to energy shocks in Europe and policy changes in major economies like China and the United States-have underscored the importance of diversification not only in investment portfolios but also in operating models. In 2026, forward-looking business owners increasingly treat diversification as a strategic imperative rather than a defensive afterthought.

This diversification can take multiple forms. Many founders who began in a focused niche-such as e-commerce in the United Kingdom or professional services in Canada-have expanded into adjacent offerings like digital education, SaaS tools, or membership communities, creating layered revenue structures that are less vulnerable to single-point failures. Others have embraced cross-border expansion, entering markets in Southeast Asia, the Middle East, or Latin America through partnerships, licensing, or digital distribution, thereby spreading both opportunity and risk. Guidance on such expansion strategies is frequently linked to the global perspectives available on TradeProfession's global section and the innovation-focused content at TradeProfession's innovation hub.

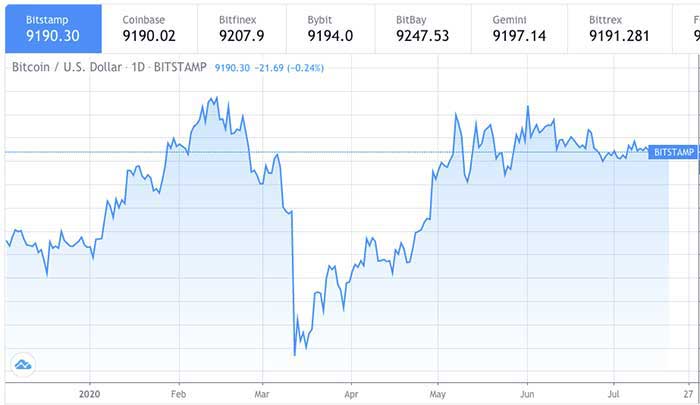

On the capital side, diversification spans traditional equities, fixed income, real estate, private equity, venture capital, and increasingly, regulated digital assets. While the crypto markets have matured and become more tightly linked to institutional finance, they remain volatile and require disciplined risk management. Business owners exploring this space often combine educational resources like TradeProfession's crypto coverage with external references such as European Central Bank digital finance publications or Financial Conduct Authority (UK) guidance on digital assets and market integrity.

Intelligent Leverage, Debt Discipline, and Capital Structure

Debt remains a powerful instrument in the hands of disciplined entrepreneurs, but in the context of rising and fluctuating interest rates across North America, Europe, and Asia, the cost of mismanaging leverage has increased. Financial freedom in 2026 therefore involves a nuanced understanding of capital structure: when to finance growth through retained earnings, when to seek equity partners, and when to employ debt strategically.

Business owners must evaluate their debt service capacity under multiple scenarios, including revenue contractions or currency shifts, and set covenants and repayment schedules that preserve flexibility. They also increasingly rely on independent advisors or virtual CFO services to stress-test their capital structure and negotiate terms with lenders. The broader macroeconomic conditions influencing these choices can be followed through sources such as Federal Reserve economic data (FRED) in the United States or Bank of England analyses in the United Kingdom, while TradeProfession readers can complement these perspectives with the macro coverage available in the economy section.

In many jurisdictions, particularly in the European Union, Singapore, and Canada, access to government-backed loan guarantees and innovation grants has expanded, offering alternative ways to finance technology adoption and internationalization without overburdening the balance sheet. Understanding the eligibility requirements, compliance obligations, and long-term implications of such programs is now a core component of strategic financial planning, often covered in executive education programs and policy briefings that are highlighted on TradeProfession's education page.

Long-Term Investing and the Rise of Sustainable, Intelligent Capital

Transforming active business income into long-term, compounding wealth is a central pillar of entrepreneurial financial freedom. In 2026, business owners are increasingly sophisticated allocators of capital, combining traditional portfolio theory with new asset classes and sustainability considerations. Equities, bonds, and diversified ETFs remain the backbone of many portfolios, often managed through platforms that offer global access to markets in the United States, Europe, Japan, and emerging economies. Complementing these, many entrepreneurs invest directly in private businesses, venture funds, or real assets such as infrastructure and logistics hubs, particularly in growth markets like India, Vietnam, and Brazil.

Sustainable investing has moved from niche to mainstream. Environmental, social, and governance (ESG) criteria are now integrated into the investment processes of major asset managers, and entrepreneurs are increasingly aligning their portfolios with climate and social impact objectives. External platforms such as UN Principles for Responsible Investment (UN PRI) and World Economic Forum provide frameworks for understanding how sustainability influences long-term value creation, while TradeProfession.com offers applied perspectives in its sustainable business section and investment hub.

Crucially, long-term investing for business owners must be integrated with liquidity planning, tax optimization, and succession strategy. This requires collaboration with wealth managers, tax advisors, and legal counsel across multiple jurisdictions if the entrepreneur operates globally. The interplay between corporate strategy and personal wealth planning is a recurring topic on TradeProfession's personal finance page, reflecting the reality that for many founders, the line between business and personal balance sheets is both powerful and porous.

Technology as a Force Multiplier for Financial Autonomy

In 2026, technology is not merely a support function but a core driver of financial freedom. Automation, AI, and cloud-native architectures allow businesses to scale revenue without proportionally increasing headcount or fixed costs, thereby expanding margins and freeing up capital for reinvestment. For the TradeProfession.com audience, this is particularly evident in sectors such as fintech, AI-driven marketing, and digital education, where the marginal cost of serving additional customers is near zero once platforms are built.

AI tools are now deeply embedded in forecasting, risk modeling, marketing optimization, and customer service. Predictive analytics platforms help entrepreneurs in Germany, Canada, or Singapore anticipate demand shifts, while intelligent pricing engines adjust offers in real time across e-commerce channels in the United States, the United Kingdom, or Australia. To understand how these capabilities are evolving, business leaders often turn to resources like Harvard Business Review's technology and analytics coverage alongside the practical case studies and analysis available on TradeProfession's technology and innovation pages.

In parallel, low-code and no-code platforms have reduced the barrier to building internal tools and customer-facing applications, enabling smaller enterprises in regions like Scandinavia, South Africa, and New Zealand to compete with larger incumbents. By systematizing operations and codifying institutional knowledge into workflows and software, business owners can gradually detach their personal time from the daily functioning of the company, a prerequisite for true financial and lifestyle autonomy.

Tax, Legal Structure, and Cross-Border Strategy

Effective tax planning and legal structuring are among the most powerful yet underutilized levers for entrepreneurial financial freedom. In 2026, as tax authorities in the European Union, North America, and Asia intensify their focus on transparency, transfer pricing, and digital economy taxation, business owners must design structures that are both efficient and fully compliant. This often involves carefully selecting jurisdictions for incorporation, holding companies, and intellectual property, as well as understanding how double taxation treaties and controlled foreign corporation rules apply to their operations.

Entrepreneurs with operations or investments across the United States, the United Kingdom, Singapore, and the Netherlands, for example, may work with international tax advisors to balance corporate tax rates, withholding taxes, and substance requirements while ensuring that their structures can withstand regulatory scrutiny. Guidance from organizations such as OECD's tax policy center and national tax authorities helps shape these strategies, while TradeProfession.com offers context-specific insights through its business and global sections.

In addition, the rise of remote work and distributed teams has introduced new complexities around permanent establishment, payroll taxes, and social security contributions in countries from France and Italy to Thailand and Malaysia. Platforms that manage global employment and compliance have become essential, but they must be integrated into a broader legal and financial architecture that aligns with the owner's long-term objectives, including eventual exit or succession planning.

Human Capital, Employment Strategy, and the Cost of Talent

No discussion of financial freedom for business owners in 2026 is complete without considering human capital. Talent strategy directly influences profitability, scalability, and ultimately the owner's ability to step back from the day-to-day. Across markets such as the United States, Germany, Sweden, and Japan, competition for highly skilled workers in AI, cybersecurity, and product development has intensified, driving compensation costs upward while also raising the stakes for getting hiring decisions right.

Many businesses now operate with a blended workforce model that combines core employees, specialized contractors, and global freelancers. This allows for greater flexibility in cost structures and access to niche expertise in regions like Eastern Europe, Southeast Asia, and Africa. However, it also demands stronger systems for performance management, knowledge sharing, and cultural cohesion. Thought leadership on the future of work can be found through sources such as World Economic Forum's Future of Jobs reports and the employment-focused guidance provided on TradeProfession's employment section and jobs page.

For business owners, aligning compensation mechanisms-such as equity participation, profit-sharing, or long-term incentive plans-with company performance is central to creating a workforce that supports, rather than constrains, financial freedom. When teams are empowered, accountable, and incentivized to think like owners, the founder's role can shift from operational control to strategic oversight, unlocking both time and mental bandwidth for higher-level wealth planning.

Risk Management, Global Shocks, and Financial Resilience

The years leading up to 2026 have reinforced a fundamental truth: risk can be mitigated but never fully eliminated. From pandemics and geopolitical conflicts to cyberattacks and climate-related disruptions, global shocks have become more frequent and interconnected. Financial freedom for business owners therefore depends on building resilience at multiple levels: operational, financial, technological, and reputational.

This involves adopting comprehensive risk management frameworks that cover insurance, cyber defense, supply chain diversification, and contingency planning. Business owners in the United States, Europe, and Asia increasingly use scenario analysis to test how their enterprises would perform under different stress conditions, such as a sharp interest rate hike, a key supplier failure, or a major data breach. External resources like World Economic Forum's Global Risks Report and Marsh McLennan's risk insights help contextualize these threats at a macro level, while TradeProfession readers often connect these perspectives to the more targeted coverage in the economy and news sections.

Insurance strategies now extend beyond traditional property and liability coverage to include cyber insurance, business interruption policies, and key person insurance for founders and executives. Combined with prudent balance sheet management and diversified revenue streams, these measures form a protective shield that allows owners to navigate uncertainty without sacrificing long-term opportunity.

Leadership, Vision, and Legacy in the Age of Intelligent Capital

Ultimately, financial freedom for business owners in 2026 is as much a leadership challenge as it is a technical one. The most successful entrepreneurs across regions-from North America and Europe to Asia-Pacific and Africa-are those who can articulate a clear vision, build systems and teams that can execute independently, and maintain the discipline to allocate capital in alignment with their long-term objectives.

For the TradeProfession.com audience, this means thinking beyond the immediate horizon of quarterly results or the next funding round, and instead cultivating a multi-decade perspective that encompasses personal goals, family priorities, and societal impact. Leadership development resources, including executive coaching, peer networks, and advanced programs from institutions such as INSEAD or London Business School, play a growing role in helping founders and executives refine this perspective. Within TradeProfession's ecosystem, readers can explore these themes in greater depth through the executive and founders sections, which focus on the intersection of leadership, strategy, and wealth.

Legacy-building-whether through philanthropy, impact investing, or the creation of enduring institutions-has become a natural extension of financial freedom for many business owners. By designing governance structures, succession plans, and capital allocation policies that outlast their own active involvement, entrepreneurs in countries from Canada and Switzerland to South Africa and New Zealand ensure that the value they create continues to compound for future generations and broader communities.

In this sense, financial freedom in 2026 is not an endpoint but a platform: a stable base from which business owners can innovate more boldly, contribute more meaningfully, and live with greater autonomy and purpose. By integrating robust financial systems, intelligent technology, diversified investments, and principled leadership, the readers of TradeProfession.com can navigate an increasingly complex global landscape while preserving the one asset that underpins all others-the freedom to choose their own strategic path.

For those seeking to deepen their understanding of these interconnected themes, TradeProfession.com offers ongoing analysis and perspectives across key domains including artificial intelligence, the global economy, international markets, investment strategy, and sustainable business, providing a trusted platform for business owners committed to building enduring, intelligent wealth in the decade ahead.