The Global Consumer Goods Market in 2026: Scale, Disruption, and Strategic Reinvention

A Market at an Inflection Point

By early 2026, the global consumer goods industry stands at a decisive inflection point. Structural forces that have been building for more than a decade-digitalization, sustainability imperatives, demographic shifts, and the normalization of e-commerce-are now intersecting with persistent inflation, geopolitical tension, supply chain reconfiguration, and a new generation of insurgent brands that challenge the dominance of long-established incumbents. For TradeProfession.com, whose readers operate across domains such as Business, Innovation, Technology, Sustainable, Global, Economy, and Investment, the consumer goods sector is no longer a peripheral interest but a central arena where strategy, capital, and technology converge.

In 2026, the sector remains enormous in absolute terms and systemically important to the global economy, yet the legacy playbook that once guaranteed predictable growth has lost its potency. Executives, founders, investors, and policymakers now confront a marketplace where scale must be fused with agility, and where brand equity must be constantly renewed through data, insight, and operational excellence. Against this backdrop, TradeProfession.com is positioning its analysis to help business leaders interpret the evolving signals, from the latest advances in artificial intelligence applications in industry to the implications of global trade and supply chain realignment.

Market Size, Structure, and Segmentation in 2026

Scale and Growth Outlook

Building on the momentum observed in 2024 and 2025, the fast-moving consumer goods (FMCG) segment-spanning food, beverage, home care, and personal care-continues to expand, though at a measured pace. Global FMCG value is estimated to have crossed the USD 5 trillion threshold in 2025 and is on track to continue compounding in the mid-single digits annually through the end of the decade, supported by population growth in emerging markets, urbanization, and the ongoing formalization of retail channels. Broader consumer products and retail markets, which include durable goods, electronics, and discretionary categories, are projected to approach USD 40 trillion in value by the early 2030s, reinforcing the sector's central role in household spending and employment worldwide.

This growth, however, is unevenly distributed. Mature markets in North America and Western Europe are experiencing low volume growth and a shift toward premiumization and value-added propositions, while Asia-Pacific, parts of Africa, and Latin America remain the primary sources of incremental demand. Industry analyses from organizations such as the OECD and World Bank highlight that consumption in emerging economies continues to outpace that of advanced economies, even as inflation and currency volatility periodically temper purchasing power.

Category Segmentation and Profit Pools

The consumer goods umbrella covers a diverse set of categories, each with distinct risk profiles, growth trajectories, and margin structures. Food and beverage remain the foundational component of household consumption and are heavily influenced by agricultural commodity cycles, climate-related disruptions, and regulatory scrutiny around health and nutrition. Home and personal care products, while often more resilient in downturns, are increasingly shaped by consumer expectations around ingredients, safety, and environmental impact, with regulatory frameworks in the European Union, the United States, and Asia tightening around labeling and chemical usage, as tracked by bodies such as the European Commission and the U.S. Food and Drug Administration.

Durable consumer goods and electronics occupy a more cyclical segment, sensitive to interest rates, housing markets, and broader macroeconomic sentiment. Luxury and premium goods, while representing a smaller share of total volume, continue to function as a barometer of high-income consumer confidence, with performance closely watched by analysts and investors across Banking, StockExchange, and Investment communities, including those who follow global luxury trends.

Across these categories, legacy consumer packaged goods (CPG) companies are seeing slower unit volume growth and are increasingly shifting emphasis toward portfolio mix, pricing sophistication, and margin management. They are balancing investments in core brands with exploratory bets on niche, high-growth segments such as plant-based foods, wellness-oriented products, and digitally native microbrands, while investors and executives alike turn to resources such as TradeProfession's business analysis and investment insights to evaluate where profit pools are migrating.

Consumer Behavior and Demand Drivers in 2026

Fragmented Loyalty and Elevated Expectations

Consumers in 2026 are better informed, more demanding, and less loyal than in previous cycles. The proliferation of digital touchpoints, from social platforms to marketplace reviews, has made it easier for individuals to discover, test, and switch between brands, eroding the inertia that once protected incumbents. Research from organizations such as NielsenIQ and Kantar indicates that brand loyalty is increasingly contingent on a seamless, consistent experience across channels, transparent communication, and alignment with personal values, particularly among younger demographics in the United States, Europe, and Asia.

For many consumers, especially in markets like the United Kingdom, Germany, Canada, and Australia, brand trust now encompasses not only product quality but also data privacy, responsible marketing, and evidence of ethical sourcing. This broader definition of trust has direct implications for how executives and founders design products, manage supply chains, and communicate their value propositions, themes that TradeProfession.com explores regularly in its executive leadership coverage and global strategy content.

Sustainability and ESG as Non-Negotiable

Sustainability has moved from a differentiating feature to a baseline expectation in key markets by 2026. Consumers across Europe, North America, and increasingly Asia-Pacific are scrutinizing brands' environmental and social claims more critically, often using independent sources such as CDP and Sustainability Accounting Standards Board (SASB) to verify corporate performance. Regulatory frameworks, including the EU Green Deal and extended producer responsibility schemes, are pushing companies to redesign packaging, reduce plastics, and improve recyclability, while investors rely on ESG benchmarks from providers like MSCI to guide portfolio decisions.

For consumer goods companies, this means that environmental, social, and governance (ESG) considerations are now embedded in core strategy rather than delegated to peripheral corporate social responsibility programs. Circular business models, refill and reuse systems, and low-carbon logistics are no longer experiments but critical components of long-term competitiveness. Readers of TradeProfession.com who focus on sustainability and ESG can deepen their understanding of these shifts through internal resources such as the platform's sustainable business coverage and external insights on sustainable supply chains.

AI, Data, and Hyper-Personalization

By 2026, artificial intelligence has become deeply integrated into the consumer goods value chain. Leading manufacturers and retailers use machine learning to forecast demand, optimize inventory, orchestrate dynamic pricing, and personalize marketing at scale. AI-driven analytics platforms ingest data from e-commerce transactions, loyalty programs, social media, and in-store sensors to produce granular insights into consumer behavior, enabling micro-segmentation by neighborhood, lifestyle, and even moment-of-day consumption patterns. Business leaders seeking to understand these applications often turn to resources on AI in retail and consumer goods and to TradeProfession's own artificial intelligence vertical for sector-specific perspectives.

In parallel, generative AI tools are being used to accelerate product design, content creation, and consumer research, allowing brands to test concepts rapidly and refine messaging with unprecedented speed. However, this technological leap raises new questions around data governance, algorithmic bias, and regulatory compliance, particularly in jurisdictions such as the EU and the United States, where policymakers are actively shaping AI frameworks through initiatives tracked by organizations like the OECD AI Policy Observatory and NIST. Trust in AI-enabled personalization is becoming a competitive differentiator, and companies that fail to handle data responsibly risk both regulatory sanctions and consumer backlash.

Inflation, Affordability, and Shrinking Pack Sizes

Despite some easing of headline inflation in major economies, the cumulative impact of multi-year price increases in food, energy, and housing continues to weigh on household budgets in 2026. Consumers in the United States, United Kingdom, and parts of Europe remain highly price-sensitive in everyday categories, even as they selectively trade up in premium niches that align with health, sustainability, or experiential value. Central bank policies, as reported by institutions such as the Federal Reserve and the European Central Bank, have moderated inflation but not fully neutralized its effects on purchasing power.

In response, consumer goods manufacturers have relied heavily on strategic price increases, pack-size reductions, and product reformulations to protect margins, leading to widespread public debate over "shrinkflation." This phenomenon is particularly visible in snack foods, beverages, and household essentials, where brands are introducing smaller, more affordable units alongside premium offerings. The resulting product architecture requires more sophisticated revenue management and assortment planning, disciplines that intersect directly with the Business and Economy insights regularly covered on TradeProfession's economy page.

Insurgent Brands and the Direct-to-Consumer Challenge

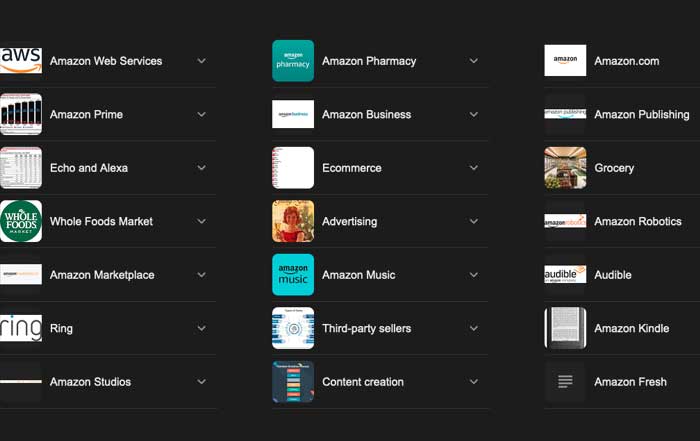

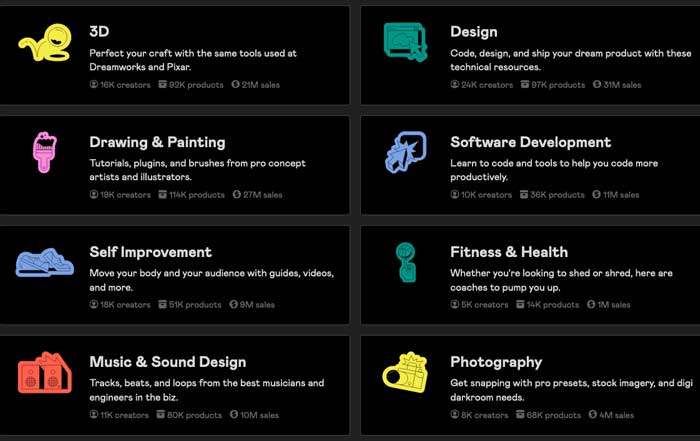

The competitive landscape continues to be reshaped by insurgent brands that have mastered direct-to-consumer (DTC) models, social-first marketing, and community-building. These challengers, often founded by entrepreneurs with deep digital fluency and a strong sense of purpose, are capturing disproportionate share of category growth in areas such as clean beauty, functional beverages, and specialized nutrition. They leverage platforms like Shopify, Amazon Marketplace, and regional e-commerce ecosystems in Asia, such as Alibaba and Shopee, to scale rapidly without the constraints of traditional retail distribution.

For incumbents, this insurgent wave is forcing a reconsideration of innovation models, marketing strategies, and portfolio design. Many large CPG firms are now incubating their own microbrands, acquiring promising startups, or forming strategic partnerships to remain relevant. Founders and executives who read TradeProfession.com and follow its founders and entrepreneurship content recognize that the consumer goods sector has become a proving ground for agile, data-native business models that may later migrate into adjacent industries.

Regional Dynamics and Market Contrasts

North America

North America, and particularly the United States, remains one of the most competitive and digitally advanced consumer markets. Retail media networks operated by major retailers are reshaping the relationship between manufacturers and distribution partners, as brands increasingly pay for access to shopper data and targeted on-platform advertising. Research on retail media and consumer data illustrates how this trend is blurring the lines between trade spend and marketing investment, compelling CPG executives to upskill in data-driven decision-making and performance measurement.

At the same time, high household debt levels, uneven wage growth, and persistent cost-of-living concerns are constraining discretionary spending. Value channels, private labels, and warehouse clubs are gaining share in several categories, even as premium niches continue to thrive among higher-income consumers. For strategy leaders and investors, TradeProfession.com provides ongoing analysis connecting these macro trends to sector-specific implications in banking and credit, employment and jobs, and technology adoption.

Europe

Europe's consumer goods landscape is characterized by strong regulatory oversight, high environmental consciousness, and a fragmented retail environment. The European Union's regulatory agenda-covering packaging waste, digital services, and supply chain transparency-exerts a powerful influence on how brands design products and manage data. Resources such as the European Environment Agency and Eurostat provide detailed visibility into consumption patterns, waste streams, and sustainability performance, which in turn inform corporate strategy.

Consumer preferences in markets such as Germany, France, Italy, Spain, and the Netherlands increasingly favor local sourcing, organic ingredients, and brands with credible sustainability credentials. Private labels are particularly strong in several European countries, intensifying price competition and forcing branded manufacturers to differentiate through innovation and brand storytelling rather than relying solely on shelf presence. For executives and marketers, TradeProfession's marketing analysis offers frameworks for navigating this high-regulation, high-expectation context.

Asia-Pacific

Asia-Pacific remains the most dynamic growth engine for consumer goods, with China, India, Southeast Asia, and South Korea at the forefront of digital innovation and consumption growth. In China, local brands have captured significant share in categories once dominated by Western multinationals, leveraging advanced social commerce ecosystems on platforms such as Tencent's WeChat and Douyin. Meanwhile, India's expanding middle class, increasing internet penetration, and logistics improvements are creating new opportunities for both domestic and international players, as documented by organizations like India Brand Equity Foundation and World Economic Forum's Asia reports.

In Southeast Asia, countries such as Thailand, Malaysia, and Indonesia are experiencing rapid digital adoption and urbanization, leading to hybrid retail models that blend traditional trade with modern e-commerce and quick-commerce services. For companies designing global strategies, understanding the nuances of these markets-regulation, payment systems, logistics infrastructure, and cultural preferences-is essential, and TradeProfession.com supports this need through its global and regional insights that connect macroeconomic developments with sector-level opportunities.

Latin America, Africa, and Other Emerging Markets

Latin America and Africa present a complex mix of volatility and opportunity. Macroeconomic instability, currency depreciation, and political risk can disrupt planning in markets such as Brazil, South Africa, and Nigeria, yet rising urban populations and the gradual formalization of retail create attractive long-term prospects. Organizations like the International Monetary Fund and UNCTAD provide macroeconomic context that consumer goods executives increasingly integrate into scenario planning.

In many of these markets, informal trade channels remain dominant, and affordability is critical. Brands that succeed often design "value bridge" portfolios, offering tiered price points and pack sizes tailored to daily cash-flow realities, while investing in localized production and distribution to mitigate import costs. For investors and strategists, these regions represent both diversification opportunities and operational challenges that require nuanced risk management, an area where TradeProfession.com continues to expand its coverage for globally minded readers.

Structural Challenges and Risk Landscape

Supply Chain Fragmentation and Resilience

Global supply chains for consumer goods have shifted from a paradigm of pure efficiency to one of resilience and optionality. Geopolitical tensions, trade disputes, and climate-related disruptions have exposed vulnerabilities in single-sourcing strategies and long, linear supply chains. Many companies are now pursuing nearshoring, dual sourcing, and increased inventory buffers, informed by insights from institutions such as the World Trade Organization and logistics research from MIT Center for Transportation & Logistics.

Digital tools, including real-time tracking, predictive analytics, and digital twins, are being deployed to increase visibility and responsiveness across the supply chain. Yet these investments require substantial capital and organizational change, raising questions for boards and executives around capital allocation, partnership models, and the balance between resilience and cost competitiveness-topics that resonate strongly with TradeProfession's audience in Executive, Investment, and Technology roles.

Regulatory Scrutiny and ESG Accountability

Regulation is tightening across multiple fronts: plastics and packaging, emissions disclosure, product safety, marketing to children, and data privacy. Governments in the United States, European Union, China, and other jurisdictions are increasingly aligned in their expectation that large consumer goods companies take responsibility for environmental and social externalities, with enforcement supported by more sophisticated monitoring and disclosure requirements. Frameworks from the Task Force on Climate-related Financial Disclosures (TCFD) and the International Sustainability Standards Board (ISSB) are shaping how companies report and manage ESG risks.

This regulatory environment amplifies the importance of governance, risk management, and stakeholder engagement. Boards are being asked to demonstrate not only compliance but strategic foresight in navigating the transition to a low-carbon, resource-efficient economy. For professionals following TradeProfession.com, especially in Executive and Sustainable domains, these developments underscore the need for integrated thinking that spans legal, operational, and reputational considerations.

Margin Compression and Innovation Pressure

Margin compression remains a central concern for consumer goods executives. Rising input costs, competitive pricing pressure, and the need for continued investment in digital capabilities and sustainability initiatives are squeezing profitability. Innovation, while essential, is not always delivering commensurate returns: incremental product extensions and superficial packaging changes often fail to generate meaningful consumer excitement or pricing power. Research on innovation in consumer goods suggests that only a minority of new product launches achieve sustained success, reinforcing the need for disciplined, consumer-centric innovation models.

This environment has heightened interest in advanced analytics, test-and-learn experimentation, and venture-style incubation within large corporations. For founders and intrapreneurs, it also creates opportunities to build focused, high-growth brands that address specific consumer pain points more effectively than broad, legacy portfolios. Readers of TradeProfession.com who engage with its innovation coverage will recognize that the discipline of innovation management is becoming as important as the creativity of the ideas themselves.

Strategic Imperatives for 2026-2030

Portfolio Focus and Capital Discipline

Over the next five years, leading consumer goods companies are expected to further concentrate their portfolios around categories and brands where they can sustain competitive advantage, while divesting non-core assets and subscale positions. This ongoing portfolio pruning is not solely about cost-cutting; it is about sharpening strategic focus, reallocating capital toward high-potential platforms, and simplifying operating models. Investors and analysts are rewarding companies that demonstrate clear capital allocation frameworks and transparent criteria for acquisitions, divestitures, and innovation bets, themes that align closely with TradeProfession's emphasis on disciplined Business and Investment thinking.

AI-First Operations and Decision-Making

AI is transitioning from a collection of pilots to the operating backbone of high-performing consumer goods organizations. Demand planning, trade promotion optimization, route-to-market design, and even product formulation are increasingly guided by AI-driven recommendations. Companies that succeed in this transformation are not merely buying technology; they are redesigning processes, reorganizing teams, and building data platforms that integrate information across marketing, sales, finance, and supply chain. Business leaders looking to understand how to orchestrate this shift can draw on both external perspectives on AI at scale and TradeProfession's internal coverage of technology and digital transformation.

Omnichannel and Direct-to-Consumer Integration

The distinction between online and offline channels continues to blur. Consumers expect to discover, evaluate, purchase, and return products seamlessly across physical stores, brand websites, marketplaces, and social platforms. For consumer goods companies, this means orchestrating consistent pricing, assortment, and brand messaging across channels, while managing potential channel conflict with retail partners. Direct-to-consumer models are no longer viewed as side experiments but as strategic capabilities that provide access to first-party data, higher margins, and deeper consumer relationships.

This omnichannel imperative requires close collaboration between marketing, sales, operations, and IT, with a strong emphasis on data integration and customer experience design. Executives and marketers can benefit from studying best practices in omnichannel retail and consumer engagement, alongside TradeProfession's own analysis of marketing and digital commerce trends.

Embedding Sustainability into the Business Model

Sustainability is evolving into a core design principle for products, packaging, and supply chains. Companies are experimenting with alternative materials, regenerative agriculture, renewable energy, and circular logistics, not only to meet regulatory requirements but to secure long-term access to resources and maintain relevance with consumers and investors. Initiatives such as Science Based Targets initiative and Ellen MacArthur Foundation's circular economy programs are guiding corporate commitments and providing frameworks for action.

For TradeProfession.com readers, particularly those engaged in Sustainable, Global, and Executive roles, the strategic question is no longer whether to integrate sustainability, but how to do so in a way that creates competitive advantage rather than merely avoiding risk. This involves cross-functional collaboration, supplier partnerships, and often a rethinking of product value propositions from the ground up.

Talent, Skills, and Organizational Agility

Finally, the transformation of the consumer goods sector is fundamentally a talent and organizational challenge. Companies need leaders and teams who can operate at the intersection of brand building, data analytics, technology, and sustainability. They must foster cultures that support experimentation, rapid learning, and cross-functional collaboration, while maintaining operational discipline in large, complex organizations. The implications for Employment, Jobs, and Education are significant, as highlighted in TradeProfession's coverage of employment trends and education and skills development.

Organizations that invest in reskilling, adaptive leadership, and new ways of working will be better positioned to navigate the uncertainties of the next decade. Those that cling to rigid hierarchies and legacy processes may find themselves outpaced by more agile competitors, regardless of their historical scale.

Implications for TradeProfession's Global Audience

For the global readership of TradeProfession.com, which spans executives, founders, investors, technologists, and policy influencers across North America, Europe, Asia, Africa, and South America, the transformation of the consumer goods industry is both a strategic challenge and a field of opportunity. The sector's vast scale, its central role in everyday life, and its exposure to macroeconomic, technological, and societal forces make it a powerful lens through which to understand broader shifts in the global economy.

Leaders in Business and Executive roles can use the consumer goods sector as a testing ground for AI-enabled decision-making, omnichannel design, and ESG integration, lessons that are transferable to other industries. Founders and innovators can identify underserved niches and pain points that lend themselves to focused, digitally native brands or enabling technologies. Investors can differentiate between companies that are merely adjusting on the margins and those that are fundamentally re-architecting their business models for a data-driven, sustainable future.

By connecting this sector-specific analysis with its broader coverage of ArtificialIntelligence, Economy, Global, Innovation, Investment, Marketing, and Technology, TradeProfession.com aims to equip its readers with the insight, context, and strategic frameworks needed to navigate 2026 and beyond. As consumer expectations evolve and competitive dynamics intensify, the organizations and individuals who succeed will be those who combine deep domain expertise with the willingness to challenge assumptions, embrace intelligent risk, and build trust through consistent, transparent action.