Social Media: How TradeProfession Readers Turn Networks into Growth Engines

Social Platforms as Business Infrastructure, Not Just Marketing Channels

Right now social media has evolved from a set of communication tools into a pervasive layer of business infrastructure that underpins how organizations across the United States, Europe, Asia, and beyond communicate, recruit, sell, innovate, and invest. With global users now exceeding five billion across major platforms, social networks function as real-time market research labs, brand stages, customer service desks, and increasingly, transaction environments. For the professionals, executives, and founders who rely on TradeProfession.com as a trusted guide to the intersection of technology, business, and global markets, social media is no longer a discretionary marketing channel; it has become a strategic asset that must be understood with the same rigor as banking, supply chains, or capital allocation.

This shift is driven by three converging forces. First, algorithmic sophistication, powered by advances in artificial intelligence and machine learning, has transformed feeds into highly personalized attention streams, where relevance and engagement are rewarded and generic messaging is quickly filtered out. Second, social commerce and integrated payment tools have compressed the traditional funnel, allowing discovery, evaluation, and purchase to occur within a single platform experience, often without a user ever visiting a standalone website. Third, regulatory and cultural expectations around privacy, transparency, and sustainability have made trust and authenticity central components of any credible digital strategy, especially for brands operating in highly regulated markets such as banking, investment, and education.

Readers of TradeProfession who are shaping strategy in sectors as diverse as banking, crypto, technology, and employment must therefore approach social media as a cross-functional discipline that blends brand positioning, data analytics, customer experience design, and ethical governance. Strategic decisions about where and how to engage on platforms like Facebook, Instagram, LinkedIn, TikTok, YouTube, X, Pinterest, Snapchat, and Threads now influence everything from capital-raising outcomes and recruitment pipelines to global expansion plans and sustainable business commitments. Those who understand this integrated landscape, and who draw on resources such as the TradeProfession Business hub and Technology insights, are better positioned to convert social presence into enduring competitive advantage.

Facebook in 2026: A Mature but Still Central Engine for Targeted Growth

Despite frequent predictions of decline, Facebook, as part of Meta Platforms, Inc., continues to play a central role in business communication and performance marketing, particularly among demographics aged 30 to 60 in North America, Europe, and parts of Asia and South America. The platform's nearly three billion monthly active users, combined with its deep integration into Instagram, Messenger, and WhatsApp, make it uniquely powerful for organizations that need both reach and precision, whether they are regional banks, global e-commerce brands, or B2B service providers.

The enduring strength of Facebook for business lies in its sophisticated ad infrastructure and data architecture. Meta's machine learning systems, trained on years of user interaction data, optimize campaigns for conversion events such as purchases, lead submissions, or app installs with a level of granularity that remains difficult to replicate elsewhere. Businesses that connect their CRM and analytics stacks to Meta Business Suite can orchestrate multi-channel campaigns, retarget website visitors, and build lookalike audiences based on high-value customer cohorts. Resources like Meta's Business Help Center and the analytics frameworks taught through Google Analytics Academy help performance marketers refine these strategies with an evidence-based approach.

For TradeProfession's audience in sectors like banking and investment, where compliance, segmentation, and measurable ROI are non-negotiable, Facebook functions as a critical component of a broader digital strategy that stretches from brand awareness to lead nurturing. When combined with insights from TradeProfession Economy on macroeconomic conditions, organizations can calibrate media spend and messaging to align with shifts in consumer confidence, interest rates, and regional market sentiment.

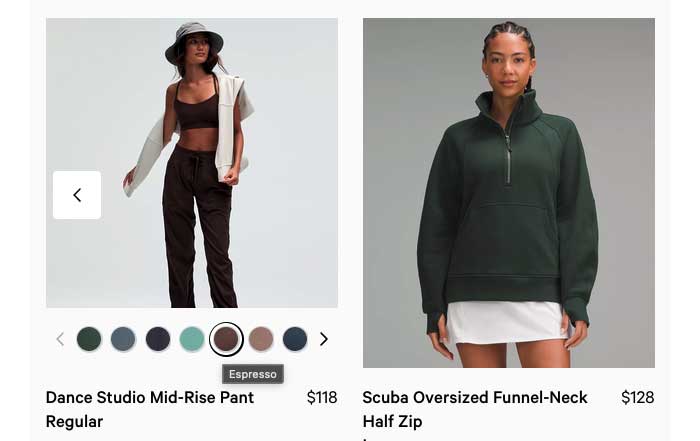

Instagram: Visual Identity, Lifestyle Positioning, and Social Commerce

Instagram remains one of the most influential platforms for shaping consumer perception, particularly in industries where aesthetics, lifestyle, and personal aspiration play a central role, such as fashion, travel, wellness, luxury goods, and increasingly, financial wellness and personal development. With more than 1.6 billion users and high penetration in markets like the United States, United Kingdom, Germany, France, Italy, Spain, and Australia, Instagram's ecosystem of Reels, Stories, and integrated Shop functionality allows brands to move fluidly from inspiration to transaction.

In 2026, the most effective organizations treat Instagram as a visual narrative engine rather than a simple gallery. They use short-form video to reveal product development, customer stories, behind-the-scenes operations, and executive perspectives, which collectively humanize the brand and build trust. They leverage creator partnerships not as one-off endorsements but as long-term collaborations that embed the brand in the everyday content diets of tightly defined communities. And they rely on data from Meta Insights and creative frameworks from resources like Canva's visual storytelling guidance to continuously test and refine how imagery, motion, and copy influence engagement and conversion.

For TradeProfession readers building cross-border brands, Instagram is also a powerful tool for localization and cultural intelligence. By monitoring how content performs in markets such as Brazil, Japan, or the Netherlands, and by aligning with local creators, organizations can adapt tone, imagery, and value propositions to resonate with regional norms and expectations. When integrated with insights from TradeProfession Marketing and Global strategy, Instagram becomes a cornerstone of international brand-building and social commerce execution.

LinkedIn: Professional Identity, B2B Growth, and Executive Authority

LinkedIn, owned by Microsoft, has consolidated its position as the global hub for professional identity, B2B marketing, and executive thought leadership. With more than one billion members spanning the United States, United Kingdom, Germany, Canada, India, Singapore, and beyond, LinkedIn now influences decisions in recruitment, procurement, partnership formation, and capital allocation. For C-level leaders, founders, and functional experts, the platform has become the primary stage on which professional reputations are constructed and scrutinized.

Organizations that use LinkedIn effectively in 2026 approach it as an integrated ecosystem rather than a job board. Company pages showcase not only products and services but also culture, sustainability commitments, and innovation roadmaps. Senior leaders share original perspectives through long-form posts and articles, positioning their organizations as credible voices on topics like AI adoption, digital transformation, and responsible investing. Sales and business development teams rely on tools like LinkedIn Sales Navigator to identify decision-makers in target accounts, orchestrate multi-touch outreach, and track engagement across complex buying committees. Guidance from sources such as Harvard Business Review supports the development of thought leadership that is substantive rather than promotional.

For TradeProfession's audience in employment, executive leadership, and jobs, LinkedIn is also a vital barometer of labor market dynamics. By monitoring skills in demand, emerging roles, and regional hiring trends, professionals can align their own development and organizational talent strategies with future needs. Resources like TradeProfession Executive and Employment insights complement LinkedIn's data by contextualizing these trends within broader technological and economic shifts.

TikTok: Algorithmic Reach, Cultural Velocity, and Commerce Integration

TikTok has cemented its position as the most influential short-form video platform, particularly for younger demographics across North America, Europe, and Asia-Pacific markets such as South Korea, Japan, Thailand, and Malaysia. Its "For You" feed, powered by highly responsive recommendation algorithms, allows even small brands to achieve outsized reach when content aligns with user interests, cultural trends, and platform-native storytelling norms. For sectors like consumer technology, fashion, gaming, and education, TikTok is now a primary discovery channel.

By 2026, TikTok Shop and live shopping features have accelerated the rise of social commerce, especially in markets where mobile-first behavior dominates. Brands that master TikTok do so by embracing authenticity, agility, and experimentation: they publish frequent, informal content; respond in real time to comments and trends; and collaborate with creators who understand the nuanced subcultures that emerge around specific hashtags and sounds. TikTok's own business resources, available through TikTok for Business, provide frameworks for campaign design, measurement, and creative best practice, while third-party insights from organizations like HubSpot and Sprout Social help marketers benchmark performance and refine strategy.

For TradeProfession readers operating in innovation and education, TikTok also offers a powerful channel for micro-learning and public engagement. Short videos breaking down complex topics such as blockchain, sustainable finance, or AI ethics can reach millions of users, influencing public understanding and brand reputation simultaneously. When aligned with strategic narratives developed through TradeProfession Innovation, TikTok becomes a medium for both growth and thought leadership.

YouTube: Long-Form Authority, Search Visibility, and Educational Depth

While social feeds have become increasingly dominated by short-form content, YouTube, owned by Alphabet Inc., remains the preeminent platform for long-form video, structured education, and durable brand storytelling. With more than 2.7 billion active users and deep integration into Google Search, YouTube operates as a hybrid of social network, video library, and global classroom. For businesses in complex or high-consideration categories-such as financial services, enterprise technology, healthcare, and professional education-YouTube is often where prospective clients and partners go to conduct serious research.

Brands that succeed on YouTube in 2026 invest in content that creates real value: detailed tutorials, case studies, product walkthroughs, analyst-style commentary, and recorded webinars or events. They treat titles, descriptions, and chapter markers as critical SEO assets, recognizing that many users arrive via search rather than subscriptions. They complement long-form content with YouTube Shorts to capture attention in the discovery phase and then guide viewers toward more in-depth material. The platform's analytics, combined with tools like YouTube for Creators, allow organizations to understand watch-time patterns, audience demographics, and content retention, enabling continuous optimization.

For TradeProfession's global audience, YouTube is also a vehicle for cross-border reach and multilingual engagement. Subtitles, localized channels, and region-specific playlists help organizations adapt to markets from Canada and Australia to Brazil, South Africa, and the Nordics. When integrated with AI-driven tools and strategic guidance from TradeProfession Technology, YouTube becomes a scalable engine for both brand authority and revenue generation.

X (Formerly Twitter): Real-Time Signaling and Market Influence

The platform now known as X, reshaped under the ownership of Elon Musk, continues to serve as the world's primary real-time conversation layer for politics, finance, technology, and culture. Despite controversy and competitive pressure, X remains highly influential among journalists, policymakers, investors, and industry insiders, particularly in the United States, United Kingdom, and major European and Asian financial centers. For companies whose fortunes are intertwined with public sentiment and market perception-such as listed corporations, crypto projects, and high-growth startups-X can move narratives and, in some cases, markets.

In 2026, organizations use X for rapid-response communication, investor relations signaling, and participation in sector-specific debates. Features such as X Spaces enable live audio discussions that function as informal conferences, while premium tiers and verification influence visibility and trust. Social listening tools, including platforms highlighted by Sprout Social's trend analyses, help brands monitor sentiment, identify emerging risks, and detect opportunities for timely engagement.

For TradeProfession readers focused on stock exchange dynamics, crypto, and global markets, X is a critical channel for tracking breaking news, regulatory updates, and thought leadership from key figures. When combined with macro perspectives from TradeProfession StockExchange and Crypto insights, X becomes part of a broader information strategy that supports faster, more informed decision-making.

Pinterest and Snapchat: Niche Depth and Youthful Intimacy

While they may not dominate headlines like TikTok or Instagram, Pinterest and Snapchat continue to offer distinctive strategic value for certain categories and demographics. Pinterest, with its visual bookmarking and search-driven architecture, acts as a powerful intent engine for lifestyle, home, travel, food, and DIY sectors. Users often arrive with a planning mindset-renovations, weddings, holidays-which makes them particularly receptive to structured inspiration tied to products and services. Brands that design high-quality, "pinnable" visuals and leverage Rich Pins to surface product data can convert inspiration into measurable traffic and sales, supported by guidance from resources such as HubSpot's social media marketing content.

Snapchat, by contrast, retains a stronghold among younger users, particularly in North America and Europe, who value intimacy, ephemerality, and augmented reality experiences. Its AR lenses, filters, and location-based features enable highly creative, time-bound campaigns that feel more like entertainment than advertising. Major global brands, including Nike and Coca-Cola, have used Snapchat to deliver immersive experiences around product launches and events, while smaller organizations exploit the platform's tools through Snap Inc. Business resources to run localized, youth-focused campaigns.

For TradeProfession readers segmenting strategies by audience age, intent, and product type, these platforms illustrate the importance of fit over ubiquity. A sustainable interior design firm in Sweden, for example, may find Pinterest far more effective than X, while a youth-oriented employment platform in Canada may achieve better engagement on Snapchat than on LinkedIn. Aligning platform choice with clearly defined objectives and target personas, as discussed across TradeProfession Personal and Jobs, is essential to maximizing return on effort and spend.

Threads and the Search for Slower, Deeper Conversation

Threads, launched by Meta as a text-centric companion to Instagram, has emerged as an alternative space for professionals and creators seeking more considered conversation than the often combative culture of X. Adoption has been particularly strong in markets where Instagram already dominates, including the United States, United Kingdom, and parts of Europe and Asia. While still evolving, Threads appeals to brands and individuals who want to blend personal narrative, professional insight, and community discussion in a relatively low-friction environment.

Organizations that experiment successfully on Threads tend to treat it as a venue for reflection rather than breaking news. Executives share behind-the-scenes thinking on strategy, product decisions, and leadership lessons; founders document the realities of building companies in volatile markets; educators and analysts unpack complex topics in accessible, conversational language. By integrating Threads management into Meta Business Suite, brands can align messaging with activity on Instagram and Facebook while maintaining the distinct tone that the platform encourages. Insights from publications like Marketing Week, accessible via resources such as Marketing Week's analysis of community marketing, help organizations understand how to foster genuine dialogue rather than one-way broadcasting.

For TradeProfession readers in founder and innovation communities, Threads offers an opportunity to build early-mover authority in a still-forming ecosystem, where algorithms are less saturated and authentic voices can gain traction quickly. When aligned with strategic narratives developed through TradeProfession Founders, Threads can become a valuable complement to more established channels.

Influencers, Data, and AI: Professionalizing the Social Growth Engine

Across all major platforms, three structural trends define high-performing social strategies in 2026: the professionalization of influencer marketing, the centrality of data analytics, and the pervasive integration of AI. Influencer marketing, once experimental and loosely measured, has matured into a sophisticated industry where brands scrutinize engagement quality, audience fit, and brand safety with the same rigor they apply to traditional media buys. Organizations leverage platforms such as Upfluence and CreatorIQ to evaluate potential partners, structure long-term collaborations, and track performance against clear KPIs. Global leaders like L'Oréal, Apple, and Gymshark demonstrate how sustained relationships with creators can shape brand equity in diverse markets from France and Italy to Japan and Brazil.

Data analytics, meanwhile, has become the backbone of decision-making. Tools like Google Analytics 4, Meta Insights, and third-party suites such as Sprout Social provide granular visibility into user journeys, campaign attribution, and audience segmentation. Education resources from Google Analytics Academy and HubSpot's data science content help marketing and strategy teams elevate their analytical literacy, ensuring that social investments are evaluated in terms of lifetime value, incremental revenue, and contribution to strategic goals rather than vanity metrics.

Layered on top of this data infrastructure, AI now permeates content creation, optimization, and customer interaction. Organizations deploy AI-driven scheduling and recommendation engines to post at optimal times, test creative variants, and personalize messaging at scale. They experiment with AI-generated copy and imagery while maintaining strict governance to protect brand voice and authenticity. They integrate conversational agents into social channels to provide always-on customer support and lead qualification. For TradeProfession readers, particularly those in artificial intelligence, technology, and innovation, resources like TradeProfession Artificial Intelligence offer strategic guidance on balancing automation with the human judgment required to preserve trust and ethical integrity.

Regional Nuances, Sustainability, and Ethical Imperatives

Despite the global reach of major platforms, effective social strategy in 2026 depends on understanding regional behavior patterns, regulatory environments, and cultural expectations. In the United States and Canada, for example, Meta platforms, YouTube, TikTok, and X dominate attention, but heightened scrutiny around data privacy and content moderation requires careful compliance and reputation management. In the European Union, where regulations such as the GDPR and evolving digital market rules shape platform operations, brands must prioritize transparency, consent, and responsible data use, particularly in markets like Germany, France, the Netherlands, and the Nordics. In Asia, super-app ecosystems and messaging platforms-alongside TikTok and YouTube-drive unique forms of commerce and community, while in Africa and South America mobile-first behavior and prepaid data constraints influence content formats and distribution tactics. Up-to-date regional data from sources like DataReportal help organizations calibrate strategies to local realities.

Overlaying these regional considerations is a growing expectation that brands demonstrate credible commitments to sustainability and social responsibility. Consumers, employees, and investors increasingly scrutinize whether digital messaging aligns with real-world behavior, particularly in areas like climate impact, diversity and inclusion, and ethical supply chains. Companies such as Patagonia, Ben & Jerry's, and Unilever exemplify how purpose-driven narratives, when backed by measurable action, can transform social channels into platforms for advocacy and community building. Guidance from organizations like Sustainable Brands, accessible at Sustainable Brands online, and from TradeProfession Sustainable, supports leaders who seek to embed sustainability into both operational practice and digital communication.

At the same time, ethical considerations around misinformation, deepfakes, and algorithmic bias have become central to responsible social media use. Global technology leaders including Microsoft and Salesforce emphasize frameworks for data ethics, AI governance, and responsible marketing, recognizing that reputational damage from perceived manipulation or deception can be swift and severe. For TradeProfession's readership, this underscores the importance of integrating compliance, legal, and risk functions into social strategy, ensuring that growth objectives are pursued within a robust ethical and regulatory framework.

From Presence to Performance

In this environment, the organizations and professionals who succeed are those who move beyond the notion of "being present" on social media and instead design integrated, performance-oriented ecosystems that connect platforms, content, data, and business outcomes. They select channels based on clear objectives-brand building, lead generation, recruitment, investor relations, or social commerce-rather than fear of missing out. They build content architectures that span formats and depths, from TikTok clips and Instagram Reels to LinkedIn essays and YouTube masterclasses. They invest in measurement capabilities that link social activity to financial and strategic metrics, drawing on resources like TradeProfession Investment and News analysis to understand how digital performance interacts with broader market conditions.

Most importantly, they treat social media as a long-term capability rather than a series of short-term campaigns. This involves cultivating internal expertise, from data-savvy marketers to socially fluent executives; establishing governance structures that address ethics, compliance, and brand consistency; and fostering a culture in which employees, partners, and customers become authentic advocates. For those who rely on TradeProfession as a trusted partner in their professional journey, the path forward involves continuous learning, disciplined experimentation, and a commitment to aligning digital presence with real-world value.

As this year rolls on, social networks will continue to evolve, new formats will emerge, and regulatory landscapes will shift. Yet the core principle will remain constant: in a world where attention is scarce and trust is fragile, the organizations that thrive will be those that use social media not merely to communicate, but to demonstrate expertise, embody their values, and build relationships that endure beyond any single platform or trend.