Profit, Purpose, and Data: How America's Top Apparel Brands Lead in 2026

The U.S. apparel market in 2026 remains one of the world's most competitive and strategically revealing consumer sectors, offering a clear lens into how brands convert creativity, technology, and ethics into durable profitability. Despite inflationary pressures, geopolitical uncertainty, tightening monetary policy, and persistent disruptions in global supply chains, leading American and international apparel companies operating in the United States continue to generate strong margins and shareholder value. Their resilience is not accidental; it is the product of disciplined strategy, advanced analytics, sustainability integration, and an increasingly sophisticated understanding of consumer psychology.

For the executive, founder, investor, or functional leader reading this analysis on TradeProfession.com, especially those engaged in business, innovation, investment, technology, and sustainable enterprise, the evolution of the U.S. apparel sector offers not only sector-specific insights but also broadly applicable lessons in digital transformation, capital allocation, and leadership. The most profitable apparel brands now operate as technology-enabled, data-rich ecosystems rather than traditional fashion houses, and their playbooks increasingly shape practices in banking, retail, logistics, and even professional services.

The 2026 Apparel Profit Equation: Beyond Volume and Markup

In the mid-2020s, profitability in apparel has shifted decisively away from a narrow focus on unit volume and gross markup toward a multi-dimensional equation that integrates data science, omnichannel orchestration, brand equity, and environmental stewardship. The most successful companies treat each product not simply as a garment but as a node within a larger system of recurring engagement, lifetime value, and network effects.

From a financial perspective, leading apparel brands in the United States have optimized around several critical levers. First, they have reoriented their business models toward direct-to-consumer channels, capturing higher margins and richer data than legacy wholesale models allowed. Second, they deploy artificial intelligence and machine learning for demand forecasting, dynamic pricing, inventory optimization, and personalization, significantly reducing markdown risk and working-capital drag. Third, they embed sustainability into sourcing, design, and logistics, not as a marketing afterthought but as a core driver of cost reduction, risk management, and brand trust. Executives studying artificial intelligence in commerce will recognize that apparel has become a proving ground for applied AI at scale.

Culturally, apparel profitability in the United States is inseparable from influence. Brands that secure a place in everyday life - in sports, entertainment, workplace culture, and social media - benefit from a form of emotional equity that lowers acquisition costs and supports premium pricing. In practice, this means that the U.S. apparel leaders of 2026 are not merely selling performance wear, denim, or outerwear; they are selling identity, aspiration, and alignment with values such as wellness, inclusivity, and environmental responsibility. This synthesis of data, culture, and ethics is what enables them to sustain margins despite intense competition and rising operational complexity.

Nike: Algorithmic Precision and Global Cultural Scale

Nike, Inc. remains the benchmark for profitability and brand power in the U.S. apparel universe in 2026. Its headquarters in Oregon anchor a global organization that fuses sports science, digital technology, and storytelling into a single, tightly managed profit engine. The company's long-term strategic pivot toward direct-to-consumer sales, accelerated in the early 2020s, now accounts for a commanding share of its revenue and an even larger share of its operating income, as proprietary e-commerce platforms and owned retail stores enable tight control of pricing, assortment, and consumer data.

Nike's digital ecosystem - including the Nike App, SNKRS, training platforms, and connected devices - functions as both a demand-generation engine and a real-time insight system. Using advanced analytics, the company forecasts demand at granular levels, calibrates inventory flows, and personalizes product recommendations, thereby reducing discounting and stockouts. Executives interested in how AI is operationalized in consumer businesses can explore how global leaders apply data-driven innovation to unlock growth and margin expansion.

From a sustainability and brand trust standpoint, Nike's "Move to Zero" initiative, with its commitments to renewable energy, recycled materials, and low-carbon logistics, has evolved from a communications platform into a risk-management strategy aligned with tightening regulations in the United States, Europe, and Asia. By embedding sustainability metrics into product development and supplier selection, Nike protects its license to operate while appealing to younger, values-driven consumers across the United States, the United Kingdom, Germany, and beyond. For senior leaders, the Nike case underlines that profitability in 2026 is increasingly tied to the ability to integrate environmental, social, and governance considerations directly into the core P&L.

Lululemon: Premium Community, High-Margin Discipline

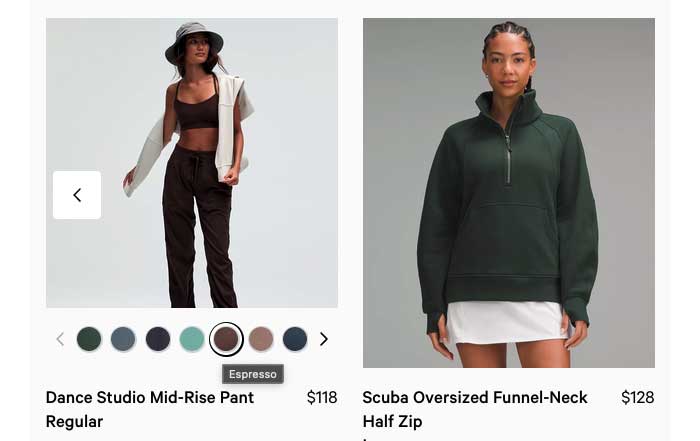

Lululemon Athletica continues to be one of the most profitable apparel companies per square foot of retail space in North America, with the U.S. market as its primary earnings engine. What began as a yoga-inspired niche brand has matured into a diversified lifestyle and performance company with strong footholds in women's and men's activewear, accessories, and connected fitness. The brand's long-standing emphasis on product quality, fit, and fabric innovation allows it to maintain premium price points and low markdown rates, even as competition intensifies from global athletic and fashion players.

Lululemon's stores in the United States, Canada, Europe, and Asia-Pacific operate as high-touch community hubs where classes, events, and local partnerships reinforce emotional connection and deepen loyalty. This community architecture reduces the need for heavy above-the-line advertising and helps generate organic advocacy on social platforms. On the digital side, Lululemon continues to refine its e-commerce and mobile experiences, integrating personalized recommendations and inventory visibility to support seamless omnichannel journeys. Business leaders examining customer-centric digital strategy can see in Lululemon a model for how experience design and operational discipline reinforce each other.

The brand's approach to sustainability and mental well-being has become increasingly central to its narrative, aligning with a broader shift in major markets such as the United States, the United Kingdom, Australia, and Japan toward holistic health. For TradeProfession's executive readership, Lululemon illustrates that profit leadership in 2026 is often the outcome of a consistent, long-term focus on a clearly defined customer, supported by disciplined expansion rather than opportunistic diversification.

VF Corporation: Portfolio Strategy and Operational Resilience

VF Corporation, owner of The North Face, Vans, Timberland, and other brands, demonstrates how a diversified portfolio can be managed for both resilience and profitability across economic cycles. While individual banners may experience category-specific volatility - for example, shifts in outdoor participation or youth culture trends - VF's portfolio structure allows capital and managerial attention to be reallocated dynamically toward the strongest opportunities.

The North Face continues to benefit from the global boom in outdoor recreation and technical outerwear, particularly in markets such as the United States, Germany, Canada, and Japan, where consumers prioritize performance, durability, and environmental standards. Vans, with its deep roots in skate culture and music, leverages collaborations and limited releases to maintain cultural relevance and pricing power. Timberland's heritage in workwear and outdoor lifestyle resonates strongly in North America and Europe, where functional fashion remains a durable trend.

VF's profitability in 2026 is closely tied to its investments in digital platforms, supply-chain visibility, and sustainability certification. By deploying end-to-end traceability tools and partnering with organizations such as the Sustainable Apparel Coalition, VF enhances compliance, reduces waste, and strengthens credibility with regulators and consumers. For investors and executives, VF illustrates how a well-governed brand portfolio can serve as a hedge against sector volatility while still enabling focused, brand-specific innovation.

TJX Companies: Converting Volatility into Value

TJX Companies, the parent of T.J. Maxx, Marshalls, and HomeGoods, remains one of the most consistently profitable retailers in the United States, and its off-price model has proven particularly resilient in an era of inflation and uneven consumer confidence. By sourcing overstock, end-of-season, and special make-up merchandise from leading brands around the world, TJX transforms inventory imbalances elsewhere in the value chain into margin opportunities.

The company's buying organization is its central competitive asset. Rather than relying heavily on long-range fashion forecasting, TJX emphasizes opportunistic purchasing, rapid decision-making, and a flexible store assortment that differs by location and season. This approach, combined with relatively low marketing spend and disciplined cost control, enables strong operating margins even when middle-income consumers in North America and Europe are under pressure. Leaders studying retail operations and cost excellence can see in TJX a demonstration of how structural agility can outperform trend-driven strategies.

As e-commerce continues to grow, TJX has selectively expanded its digital capabilities while preserving the treasure-hunt experience that defines its in-store proposition. For the TradeProfession audience, TJX underscores that in 2026, profitability can be built as much on operational craft and procurement sophistication as on brand marketing and design.

Ross Stores: Scale, Simplicity, and Everyday Value

Ross Stores, operating Ross Dress for Less and dd's DISCOUNTS, has refined a similar off-price concept with a distinctive focus on simplicity and scale across the United States. Its stores are deliberately no-frills, with minimal visual merchandising and tightly controlled labor and occupancy costs. This lean operating model, coupled with strong vendor relationships and disciplined inventory turnover, allows Ross to offer compelling value while maintaining healthy margins.

In an environment where many households across the United States, Canada, and parts of Europe are trading down from premium retailers, Ross benefits from a structural tailwind. The company's decision to limit its e-commerce presence and concentrate on brick-and-mortar efficiencies may appear contrarian, yet it reflects a clear understanding of its customer base and value proposition. Executives exploring employment and retail labor trends can examine Ross's approach to staffing and process design as an example of how human capital strategy underpins retail profitability.

Ross's trajectory in 2026 reinforces a broader lesson: in certain segments, especially price-sensitive apparel, clarity of model and ruthless focus on cost can outperform more glamorous, brand-led strategies.

Gap Inc.: Technology-Led Renewal of a Legacy Portfolio

Gap Inc., once emblematic of American casualwear, has spent much of the past decade in transformation. By 2026, the company's portfolio - including Old Navy, Gap, Banana Republic, and Athleta - reflects a more disciplined emphasis on profitability, digital engagement, and brand differentiation. Old Navy continues to anchor the value segment, while Athleta has emerged as a high-growth platform at the intersection of performance, wellness, and sustainability.

Gap Inc. has invested heavily in predictive analytics, assortment optimization, and supply-chain agility, moving away from long lead times and intuition-based merchandising toward a more responsive, data-informed model. This shift has reduced markdown rates and improved working capital efficiency, particularly in the U.S. and Canadian markets. Readers interested in how established organizations modernize their operating models can learn more about enterprise digital transformation as a catalyst for margin improvement.

Athleta's growth story, with its focus on female empowerment, body positivity, and sustainable materials, illustrates how a sub-brand can be positioned as a modern, purpose-driven asset within a larger corporate structure. For executives managing multi-brand portfolios, Gap Inc. offers a case study in how to sunset underperforming initiatives, reallocate capital, and rebuild relevance through targeted innovation.

Ralph Lauren: Heritage, Luxury, and Global Consistency

Ralph Lauren remains one of the most enduring and profitable American apparel houses, with a brand that continues to symbolize aspirational lifestyle across North America, Europe, and Asia. Its profitability in 2026 is grounded in disciplined brand management, controlled distribution, and a careful balance between heritage and modernity. The company's portfolio - spanning Polo, Purple Label, Lauren, and other lines - allows it to serve multiple price tiers without diluting its core identity.

Ralph Lauren has invested significantly in digital storytelling, immersive e-commerce, and data-driven CRM, enabling a richer understanding of customer behavior across markets such as the United States, the United Kingdom, France, and Japan. Virtual flagship experiences and curated digital capsules complement a selective wholesale and retail footprint, preserving scarcity and pricing power. Those interested in global brand building will note how Ralph Lauren maintains a coherent narrative while tailoring assortments and campaigns to local cultural contexts.

Sustainability has also moved closer to the center of the company's strategy, with commitments to responsible sourcing, circularity initiatives, and reduced environmental impact. For TradeProfession readers, Ralph Lauren's trajectory demonstrates that in 2026, heritage and innovation are not opposites; rather, they can be integrated to reinforce both emotional resonance and financial performance.

Levi Strauss & Co.: Circular Denim and Durable Margins

Levi Strauss & Co. continues to be a benchmark for profitable, purpose-infused denim. With a global footprint spanning the United States, Europe, and Asia, Levi's has capitalized on its iconic status while modernizing its product, distribution, and sustainability practices. Direct-to-consumer stores and e-commerce play an increasingly central role in its U.S. and European strategies, allowing the company to showcase full-price collections and premium collaborations while gaining deeper insight into consumer preferences.

Levi's has been at the forefront of circular fashion initiatives, including take-back programs, resale platforms, and repair services that extend garment life and reduce waste. These programs not only support environmental goals but also enhance customer loyalty and open new revenue streams. Leaders interested in how to learn more about sustainable business practices can view Levi's as an applied example of circular economy principles in a mass-market context.

Technologically, Levi's employs advanced analytics and digital design tools to reduce sampling, shorten development cycles, and align production more closely with demand across the United States, Germany, Spain, and other key markets. For investors and executives, Levi Strauss & Co. illustrates that sustainability, when embedded in design and operations, is not a cost center but a structural contributor to margin resilience.

HanesBrands and Gildan: Fundamentals, Scale, and Everyday Necessities

HanesBrands, together with Gildan Activewear following acquisition and integration efforts, demonstrates how profitability can be built on the foundations of basics rather than fashion. Dominating categories such as underwear, socks, and activewear essentials across North America and beyond, these companies rely on massive scale, vertically integrated manufacturing, and rigorous cost control to deliver reliable cash flows.

Their operational model, often centered on owned production facilities in regions such as Central America and the Caribbean, enables tight oversight of costs, quality, and compliance. Investments in automation and energy efficiency contribute to both margin improvement and environmental performance, aligning with evolving expectations from regulators and institutional investors. Industry observers can explore how global supply chains are reshaping cost structures in response to geopolitical shifts and nearshoring trends.

While these businesses may lack the cultural cachet of luxury or performance brands, their stability and predictability make them attractive components of diversified investment portfolios. For TradeProfession's readership, HanesBrands and Gildan underscore that in 2026, not every profitable apparel story is about trendsetting; some are about operational mastery in categories with steady, non-discretionary demand.

American Eagle Outfitters and Aerie: Authenticity as a Growth Engine

American Eagle Outfitters (AEO), and particularly its Aerie sub-brand, has continued to translate inclusive, authenticity-led positioning into profitable growth across the United States and international markets. Aerie's commitment to unretouched imagery, diverse representation, and body positivity has created a powerful emotional bond with Gen Z and younger millennials, who increasingly expect alignment between corporate messaging and operational reality.

This brand trust translates into strong full-price sell-through and robust online engagement, supported by a sophisticated omnichannel infrastructure that integrates stores, mobile, and social commerce. AEO's analytics capabilities enable targeted promotions, localized assortments, and efficient inventory management, supporting margins even as the competitive landscape intensifies. Marketers and executives can explore consumer behavior trends to better understand why authenticity and transparency are now central to brand equity.

For TradeProfession readers focused on marketing and growth, AEO and Aerie provide a compelling example of how values-driven storytelling, when backed by consistent execution, can become a durable competitive advantage.

Abercrombie & Fitch: A Textbook Turnaround

Abercrombie & Fitch has, by 2026, completed one of the most closely watched and instructive brand turnarounds in modern retail. Once associated with exclusivity and narrow definitions of beauty, the company has repositioned itself as an inclusive, quality-focused, and digitally savvy brand appealing to a broader demographic. This transformation has involved product redesign, store reformatting, pricing recalibration, and a complete overhaul of marketing tone and imagery.

The results have been visible in sustained revenue growth and margin expansion, particularly in the U.S., U.K., and European markets where the brand has rebuilt relevance. Abercrombie's leadership leveraged data-driven insights to refine assortments, reduce overproduction, and align inventory with real demand, thereby lowering markdowns and improving gross margin. Executives interested in corporate renewal can study case-based perspectives on turnarounds to see how culture change, capital discipline, and brand repositioning intersect.

For the TradeProfession audience, Abercrombie & Fitch demonstrates that reputational liabilities can be addressed through humility, consistency, and long-term commitment, and that such efforts, when credible, can unlock substantial financial upside.

Aritzia: Minimalism, Experience, and Quiet Power

Aritzia, originally Canadian but increasingly influential in the U.S. market, has built a profitable franchise around elevated minimalism and curated in-house brands. Its boutiques in the United States and Europe are designed as calm, high-touch environments where styling, service, and atmosphere reinforce the perception of quality and justify premium pricing. Despite its growth, Aritzia has resisted overextension, carefully selecting locations and managing inventory to preserve scarcity and desirability.

The company's digital platform complements its physical presence with strong visual merchandising, editorial content, and seamless logistics, supporting high conversion rates and strong customer retention. Aritzia's profitability in 2026 is a result of disciplined SKU management, tight control of design and production, and a clear understanding of its core customer: modern professionals seeking timeless, versatile pieces. Leaders exploring innovation in retail formats can view Aritzia as an example of how "boutique at scale" is achievable with the right operating model.

For TradeProfession readers, Aritzia's rise underscores that there is still room for new or relatively young players to carve out profitable niches, provided they combine aesthetic clarity with operational rigor.

Moncler: Performance Luxury and Global Scarcity

Moncler, while Italian in origin, has built a highly profitable presence in the U.S., European, and Asian markets by positioning itself at the intersection of performance outerwear and high fashion. Its strategy hinges on limited production runs, seasonal capsules, and high-profile collaborations that maintain scarcity and justify premium price points. Moncler's U.S. business, particularly in cities such as New York, Chicago, and Denver, benefits from both functional demand for technical outerwear and symbolic demand for status signaling.

The company's profitability is reinforced by tight distribution control and selective wholesale partnerships, which protect brand equity and reduce the risk of overexposure. Moncler also invests in advanced materials and sustainable practices, aligning with regulatory and consumer expectations in markets such as the European Union and Japan. Executives interested in luxury brand economics can analyze Moncler's approach to scarcity, pricing, and innovation as a template for premium positioning.

For TradeProfession's readership, Moncler illustrates that even in a crowded category like outerwear, a brand can command exceptional margins when it combines technical credibility with cultural cachet and disciplined channel management.

Converse and Vans: Cultural Icons as Apparel Platforms

Converse and Vans, both deeply embedded in youth and street culture, demonstrate how footwear-origin brands can successfully expand into apparel while maintaining profitability and relevance. Converse, under the umbrella of Nike, leverages its iconic Chuck Taylor heritage to sell apparel and accessories that resonate with consumers in the United States, Europe, and Asia who value authenticity and timeless design. Vans, within VF Corporation, continues to draw on skateboarding, music, and art communities to inform its collections and collaborations.

Both brands benefit from a unique form of emotional durability: their products are often associated with formative life stages, subcultures, and personal identity, which supports repeat purchases and multi-generational appeal. Their apparel lines, often featuring graphic treatments and logo-driven designs, enjoy high margin potential due to relatively low production costs and strong brand pull. Those examining founder-led cultural brands can see in Converse and Vans how deep cultural roots can be extended into adjacent categories without diluting core meaning.

For the TradeProfession audience, these brands highlight the importance of cultural fluency and community engagement as strategic assets in 2026's apparel economy.

Adidas and Puma: Global Competitors, Localized Strategies

Adidas and Puma, two European giants, continue to treat the U.S. apparel and footwear market as a critical growth and profitability arena, while also expanding across Asia, Latin America, and Africa. Adidas has focused on regaining share in North America through a combination of performance innovation, lifestyle collaborations, and sustainability initiatives such as its work with Parley for the Oceans, which converts ocean plastic into high-performance materials. Puma has leaned into partnerships with musicians, athletes, and cultural figures to reinforce its image as a dynamic, accessible brand with strong roots in sport and entertainment.

Both companies have accelerated their direct-to-consumer strategies, investing in flagship stores, e-commerce, and membership programs that deepen engagement and provide valuable data. Their profitability in 2026 reflects improved product mix, tighter inventory control, and a clearer segmentation of performance versus lifestyle offerings. Executives interested in cross-border strategy can study how these companies localize product and marketing for the U.S., Chinese, and European markets while maintaining a coherent global identity.

For TradeProfession readers, Adidas and Puma underscore that in a globalized apparel landscape, success requires both scale and sensitivity to local cultural and regulatory environments.

Under Armour: Refocusing on Performance and Profitability

Under Armour has spent much of the past few years recalibrating its strategy after a period of overexpansion and inconsistent execution. By 2026, the company has refocused on its core strength: performance apparel and footwear for serious athletes and fitness enthusiasts in markets such as the United States, Canada, and parts of Europe and Asia. This strategic narrowing has allowed Under Armour to rationalize its product portfolio, improve gross margins, and restore brand clarity.

The company has invested in digital tools for demand planning, inventory visibility, and consumer analytics, enabling more precise allocation of product and reduced reliance on discounting. Its direct-to-consumer business, including e-commerce and brand houses, has become a larger share of revenue, supporting higher average selling prices and better control over brand presentation. Leaders examining executive decision-making in turnarounds can draw lessons from Under Armour's willingness to retrench, prioritize profitability over rapid top-line growth, and realign organizational incentives.

For the TradeProfession community, Under Armour's journey reinforces that in 2026, strategic focus and operational discipline remain powerful levers for restoring financial health, even in highly competitive categories.

Patagonia: Purpose, Governance, and Profitable Stewardship

Patagonia continues to serve as a global reference point for purpose-driven business, with a model that tightly integrates environmental activism, product excellence, and financial sustainability. The company's decision to structure ownership in service of the planet, channeling profits toward environmental causes, has only deepened customer loyalty and brand distinctiveness across the United States, Europe, and Asia-Pacific.

Patagonia's products are designed for durability, repairability, and multi-decade use, which supports premium pricing and reduces the need for frequent replacement. Programs such as Worn Wear, which facilitate repair and resale, exemplify how circular models can generate revenue while reducing environmental impact. Executives interested in climate-conscious business models can examine Patagonia as a real-world experiment in aligning governance, operations, and advocacy.

For TradeProfession readers, Patagonia demonstrates that trust and transparency can become core economic assets, enabling a company to maintain profitability and resilience even while challenging conventional growth paradigms.

Buck Mason: Focused Craft in a Direct-to-Consumer World

Buck Mason, a U.S.-based direct-to-consumer brand, exemplifies a new generation of apparel companies that prioritize timeless design, high-quality materials, and controlled growth. Its collections focus on essentials such as T-shirts, denim, and outerwear, avoiding the churn of fast fashion and instead emphasizing longevity and fit. This approach reduces complexity in design, sourcing, and inventory, allowing for healthy margins and predictable cash flow.

The brand's retail footprint, primarily in the United States, is curated and measured, with stores designed to feel like extensions of the online experience. Buck Mason's marketing leans heavily on storytelling, craftsmanship, and authenticity rather than aggressive discounting or trend-chasing. Entrepreneurs and founders can explore direct-to-consumer strategies to understand how tight product focus and vertical integration can support sustainable growth without requiring massive external capital.

For TradeProfession's audience, Buck Mason underlines a key insight of 2026: in a crowded digital marketplace, clarity of product and integrity of execution can be more powerful than scale alone.

Nuuly and the Rise of Rental and Resale Models

Nuuly, the rental and resale platform owned by URBN (parent of Urban Outfitters and Anthropologie), represents a structural innovation in how apparel profitability is conceived. Instead of relying solely on one-time purchases, Nuuly generates recurring subscription revenue by renting garments to consumers who value variety, experimentation, and sustainability. In parallel, its resale marketplace extends the life of garments and taps into the fast-growing recommerce segment in the United States and beyond.

Nuuly's profitability depends on sophisticated data analytics to predict demand, optimize garment utilization, and manage logistics and cleaning processes efficiently. Its model is closely watched by both traditional retailers and technology investors as an example of how asset-light, digitally orchestrated platforms can coexist with, and complement, conventional retail. Those interested in the intersection of technology and new consumer models can study Nuuly as an early but influential signal of how access-based consumption may reshape revenue structures in apparel and adjacent sectors.

For TradeProfession readers, Nuuly illustrates how innovation in business model design, not just in product, can unlock new forms of profitability aligned with changing consumer values and environmental imperatives.

Strategic Takeaways for TradeProfession's Global Audience

Across these leading brands and business models, several themes emerge that are directly relevant to TradeProfession's readership, whether they operate in apparel, financial services, technology, or other industries. First, data and AI have become non-negotiable components of profitability, enabling companies to forecast demand, personalize engagement, and optimize supply chains with a precision that was impossible a decade ago. Leaders seeking to deepen their understanding of macroeconomic and sectoral context can explore the economy and news sections of TradeProfession to stay aligned with broader trends.

Second, sustainability has moved from the margins to the core of strategy, influencing sourcing, product design, logistics, and corporate governance. Brands such as Patagonia, Levi Strauss & Co., and Adidas demonstrate that environmental responsibility can coexist with, and indeed reinforce, profitability. Executives and investors can build on these insights by examining how sustainable practices intersect with capital markets, regulation, and consumer behavior across North America, Europe, Asia, and emerging markets.

Third, emotional connection - whether grounded in heritage, inclusivity, community, or activism - is now a central determinant of pricing power and customer lifetime value. Brands that succeed in 2026 do not simply talk about values; they operationalize them in hiring, product, partnerships, and governance. This alignment builds trust, which in turn lowers acquisition costs and supports premium positioning.

Finally, the U.S. apparel sector underscores that leadership quality remains decisive. The most successful organizations are led by executives who combine strategic clarity with humility, who embrace analytics without abandoning intuition, and who recognize that in volatile markets, resilience is built through diversification, disciplined capital allocation, and a willingness to adapt.

For readers of TradeProfession.com, these apparel case studies offer more than sector intelligence; they provide a framework for thinking about profitability in any industry. Whether the focus is on banking, crypto and digital assets, jobs and employment, or stock exchange dynamics, the same principles apply: harness data intelligently, build trust deliberately, innovate responsibly, and align profit with purpose.

In 2026, the most successful apparel companies are those that treat profitability as a living system rather than a static metric, continuously balancing short-term performance with long-term brand equity, environmental stewardship, and stakeholder value. For decision-makers worldwide, the lesson is clear: the future of business, in fashion and beyond, belongs to organizations that can combine executional excellence with a coherent, credible vision of their role in the global economy.